What is an ETF?

An Exchange Traded Fund, or ETF, is a fund made up of shares in listed companies, bonds, cash or other assets. “Exchange traded” means that you buy and sell ETF units on an exchange like the NZX, in the same way you buy and sell shares.

The key difference between a single listed stock and an ETF, is that an ETF gives you exposure to many companies, asset types and markets in a single investment.

Picking winners can be compared to finding a needle in the haystack. Experienced investors often say; “don’t look for the needle, just buy the entire haystack.” Smart ETFs offers an easy and affordable way to own the haystack.

ETFs are a great way to kickstart building a balanced portfolio for long-term growth. It’s no surprise that ETFs are one of the fastest growing investment products in the world.

How do ETFs work?

Many ETFs are index-tracking, meaning they're invested in the securities that are in the market index they are designed to track, like the S&P 500 or the S&P/ASX 200. This provides exposure to a range of markets and industries that you may not be able to invest in on an individual basis.

The aim of the ETF is to mirror the performance of the group of companies or assets in the index.

Dividends and other distributions are paid in New Zealand dollars and automatically reinvested for you, unless you choose to receive them in cash.

ETFs can seem complex to understand at first, but our articles will bring you up to speed quickly.

What are the benefits of ETFs?

ETFs offer a low-cost pathway to a diversified portfolio that can easily be tailored to suit your personal investment goals. From a single investment, you can access a broad set of assets, markets and sectors.

ETFs provide more flexibility than traditional funds, as they can be bought and sold at any time during trading hours of the stock exchange.

Smart ETFs are PIE funds, making it easy to invest in local or international markets, with the advantage of knowing their tax rate (28%) and costs upfront, which also helps to simplify the administration of your investments.

Key benefits of Smart ETFs

Wide range

With a single purchase, you gain exposure to a range of assets, sectors and markets, not holding all your eggs in one basket.

With over 40 Smart ETFs to choose from, you can find the right investment mix to meet your financial goals.

Easy access

Our ETFs enable you to build a global portfolio in New Zealand dollars, without having to worry about the complexity of managing foreign currencies or overseas tax and charges.

Competitive fees

Since most of our ETFs track indices, we don’t need to make active investment decisions.

That means we don’t need to spend a lot of money on research and analytics – which helps us keep fund charges and fees low for our investors.

What are the risks of ETFs?

Like most things in life, investing comes with some risks. Understanding the key risks can help you decide if ETFs fit your financial and life goals.

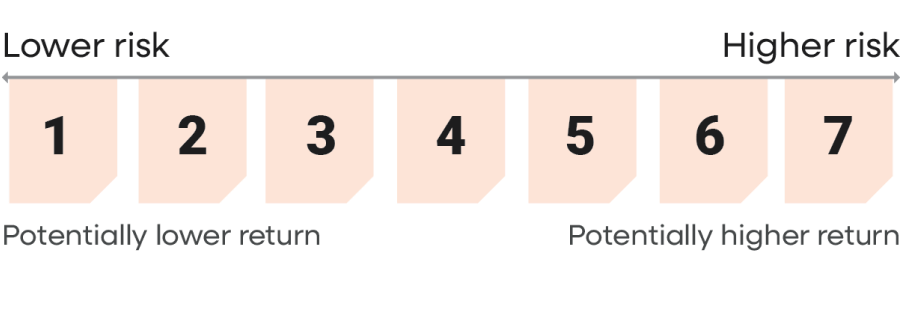

Each Smart ETF has a risk indicator to help you assess the relative risk level and compare it to other funds in New Zealand.

The risk indicator is rated from 1 (low) to 7 (high). The rating reflects how much the value of the fund’s assets will vary over time. A higher risk level generally means higher potential returns over time, but more ups and downs along the way.

Learn more about the risks involved with investing in the Smart ETFs:

Smart ETFs

Build a portfolio of diverse investments across local and global stock exchanges.

We offer over 40 ETFs. To provide a clear overview, we have grouped them into categories.

All our ETFs are listed on the NZX and priced in NZD for your convenience:

Build foundations with our Core Series

If you’re looking for a solid foundation for your portfolio, our Core Series is a great place to start. This selection of 10 ETFs covers a diverse mix of markets, industries and asset classes.

Designed for simplicity and efficiency, the Core Series makes it easy to build a diversified portfolio quickly and at low cost. This series offers hand-picked building blocks that you can choose from to give you a quick start to solid investing foundations.

FAQs

Find answers to common questions about our ETFs, investment strategies, and services.

Get the information you need to make informed financial decisions.

As a new investor directly with Smart, you can start with a minimum of $500 per ETF. If you prefer to invest regularly, you can build up your ETF holdings with as little as $50 per month.

If you decide to invest directly with us, there is a $30 set-up fee for new investors. This is a one-off fee and does not apply to additional contributions (including when you invest in additional ETFs within the scheme).

However, if you buy (or sell) units in Smart ETFs through an NZX participant, or a financial adviser, you might be charged a brokerage fee for their services.

Our ETF performance page lists our funds, with performance data that you can use to compare them.

Our Explore our ETFs and ETF performance pages are good starting points to pick your favourite funds. Before you get started, please also read the Product Disclosure Statements, to make sure you know exactly what you’ll be investing in. The next step is to pick your access point and apply to invest, explained here.

You can find all the relevant details about our funds in the Disclosure Documents, and on the individual fund pages.

The benefits of ETFs include easy diversification through a single purchase; competitive fees that ensure more of your money stays invested; and the ability to grow your investment over time through a simple regular savings plan. We offer a broad range of funds and make investing easy to access and understand.

Each fund is a listed portfolio investment entity (PIE). As a listed PIE, each fund will pay tax on taxable income at the rate of 28%.

Periods of volatility in global share markets can understandably create uncertainty for many investors. While market downturns can be unsettling, it is important to remember that volatility is a natural part of investing. Making decisions based on short-term market fluctuations can have a negative impact on your long-term returns. Learn five strategies to help navigate market swings with confidence.

To sell your investment in the Smart ETFs, you'll need to sell your units on the NZX (NZ stock exchange) through a broker. ETFs are traded in the same way as shares in a listed company.

Smart is the manager of the ETFs, but we do not facilitate the selling of ETF units directly. This gives you the flexibility to choose the broker or platform that best suits your needs when buying and selling ETFs.Smart does not charge any additional fees when you sell your units. However, you may be charged transaction or service fees through the broker or platform you select. We recommend you check with them directly to understand any costs that may apply.