The role of hedging in your portfolio

Currency hedging explained – how exchange rates impact investment returns.

An overview of currency hedging

Currency hedging serves a simple purpose: it seeks to mitigate the impact of exchange rate fluctuations on the returns from international investments.

Hedging can be a useful strategy for New Zealand investors looking to reduce the influence of exchange rate volatility, ensuring their returns more closely reflect the performance of the underlying markets in their local currencies.

Smart offers a broad range of Exchange Traded Funds (ETFs) that provide exposure to global markets, including several that are hedged to the New Zealand dollar (NZD).

The role of currency hedging

Currency hedging is widely used by organisations across the commercial sector, such as banks, exporters, and importers, to manage currency risk (the risk that foreign currencies move up or down relative to the NZD) in their international transactions.

From an investment perspective, currency hedging aims to remove some or all of the foreign currency risk implicit in owning international assets. This limits the impact of foreign exchange rate movements on investment performance.

How hedging works

Hedging involves using financial instruments, such as forward foreign exchange contracts, to offset movements in the NZD against other currencies. A forward foreign exchange contract is an agreement between two parties to buy and sell a currency at a future date at an exchange rate set today.1

Forward contracts ‘lock in’ exchange rates, effectively eliminating the impact of currency fluctuations on the returns received by investors.

It’s important to note that while currency hedging can protect against losses from unfavourable movements in the NZD (such as when it appreciates in value), it also means a hedged fund may miss out on potential gains from favourable currency movements (such as a decline in the NZD).

The impact of hedging on investment returns

The return generated by a fund holding global assets comes from two sources:

The performance of the underlying asset, and

Changes in the value of the NZD relative to the relevant foreign currency or currencies.

A hedged fund aims to eliminate the impact of currency fluctuations, with the total return reflecting only the performance of the underlying market in its local currency. In contrast, the return from an unhedged fund is a combination of the underlying market’s performance and the change in the relevant exchange rate. Table 1 below outlines four scenarios demonstrating how both the return from the underlying market and fluctuations in exchange rates influence the overall return received by investors.

Table 1. Impact of market returns and changes in the value of the NZ dollar on a NZ-based unhedged and hedged fund invested in US shares

This table is illustrative only. Actual outcomes may differ due to factors such as fees, interest rate differentials and tracking differences.

* Total Return = (Market Return) × (Change in NZD/USD).

Example: hedged vs unhedged Funds

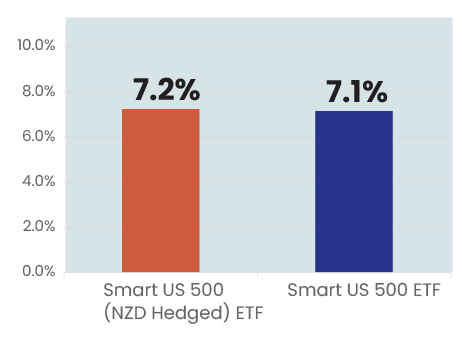

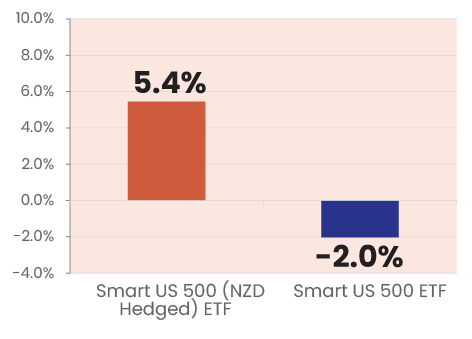

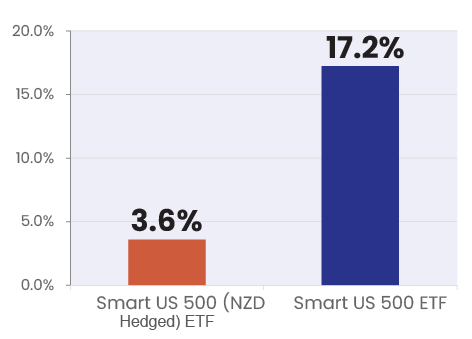

The Smart US 500 (NZD Hedged) ETF was launched in June 2023 and is offered alongside the Smart US 500 ETF, which was launched in 2015 and is unhedged. Since both funds invest in the same underlying market (US shares), we can compare their returns to highlight how changes in the NZD impact their relative performance. This comparison is illustrated in Chart 1.

The returns from the Smart US 500 (NZD Hedged) ETF reflect the performance of US shares in US dollar terms, while the returns from the Smart US 500 ETF are influenced by both the return from US shares and changes in the NZD/USD exchange rate.

Chart 1. Impact of changes in the NZD/USD on the Smart US 500 ETF (USF) and Smart US 500 (NZD Hedged) ETF (USH)

NZD/USD. June 2023 - January 2025

| Impact of no change in NZD |

| Impact of a stronger NZD |

| Impact of a weaker NZD |

Source: NZD data sourced from Reserve Bank of New Zealand. Fund returns sourced from Smart. All returns are before tax and fees.

The hedging decision

Global bonds are generally regarded as more conservative investments compared to shares and other growth assets and are typically hedged to mitigate the risks associated with the volatility of the NZD. Furthermore, they have defined, maturity periods while shares have an indefinite duration (i.e. shares do not have a maturity date as most bonds do). This characteristic further justifies the common practice of fully hedging global bond investments. This is why all Smart ETFs that invest in global bonds are hedged.

Whether to hedge global shares is a more nuanced decision. Below we outline a number of characteristics of hedged and unhedged funds. When considering currency hedging for a global shares portfolio, investors can take these factors into account, along with their financial goals, circumstances and risk profile.

Characteristics of hedged and unhedged funds

Hedged funds

Hedged funds should outperform when the NZD appreciates. A hedged fund will typically outperform an unhedged fund (invested in the same asset) if the NZD appreciates. Conversely, if the NZD depreciates, a hedged fund is likely to underperform an unhedged fund.

Hedged funds aim to eliminate currency fluctuations. Hedged funds may be suitable for investors who want exposure to the underlying market and access to its performance in local currency terms, without the impact of currency fluctuations.

Hedged funds may have higher fees.

Unhedged funds

Unhedged funds provide diversification away from the NZD. This can be an important consideration for New Zealand investors who may earn income in New Zealand and have a significant portion of their assets – such as investments, a business, or property – concentrated in New Zealand.

The NZD has, in the past, often moved in the same direction as global share markets. In the past, during periods when global share markets have declined, the NZD has often fallen at the same time. In these situations, being unhedged can help mitigate the impact of the fall in world shares. Over the 25-year period from December 1999 to December 2024, we estimate the average annual correlation between rolling 12-month returns from world shares and the change in the NZD/USD exchange rate has been 0.33.2 This suggests the change in the NZD/USD has often been similar to the movement in global share markets. Charts 2 and 3 show this relationship. However, it is important to recognise that this relationship is not always consistent – there have been periods when the NZD has strengthened despite a decline in global share markets. Additionally, this correlation is based on historical data, and future outcomes may differ. Correlations can change over time.

The impact of currency fluctuations may diminish over the longer term. While the NZD has historically experienced significant fluctuations, the average exchange rate has remained relatively stable. Over the past 40 years, the average NZD/USD exchange rate has been 0.64. Over the past five years, it has also been 0.64, and over the past 10 years, it has been 0.67. This infers that the influence of currency movements on returns tends to lessen over the long term. See chart 4.

Chart 2. World shares and NZD/USD

Annual correlation of rolling 12-month change. World shares and NZD/USD (1999-2024).

Data sources: Bloomberg (MSCI Index in USD), Reserve Bank of New Zealand (NZD/USD monthly average). Calculations by Smart.

Chart 3. Correlation of world shares and NZD/USD

Rolling 12-month change. World shares and NZD/USD (1999-2024).

Data sources: Bloomberg (MSCI Index in USD), Reserve Bank of New Zealand (NZD/USD monthly average). Calculations by Smart.

Chart 4. NZD/USD exchange rate (1985 – 2025)

Data sourced from Reserve Bank of New Zealand (NZD/USD monthly average). Jan and Feb 2025 figures estimated by Smart based on RBNZ daily NZD/USD data to 26 Feb 2025. Averages calculated by Smart.

Smart NZD hedged ETFs

Smart offers a range of both unhedged and hedged ETFs that provide exposure to global markets. Smart ETFs which are hedged to the NZD are listed in table 2. All Smart ETFs which invest in global bonds are hedged.

Table 2. Smart NZD hedged ETFs

Smart NZD Hedged ETFs | Benchmark | Asset / Market exposure |

|---|---|---|

FTSE Global All Cap Index (100% NZD Hedged). | Global shares | |

FTSE EPRA Nareit Developed ex Aus Rental Net Tax Index (100% NZD Hedged) | Global shares (listed property) | |

FTSE Developed Core Infrastructure 50/50 Net Tax Index (100% NZD Hedged) | Global shares (infrastructure sector) | |

S&P 500 Dynamic Hedged NZD Index | US shares | |

S&P 500 Capped 35/20 Information Technology Index (100% NZD Hedged) | US shares (technology sector) | |

Bloomberg Global Aggregate Treasuries (Scaled) Total Return Index (100% NZD Hedged) | Global bonds | |

Bloomberg Global Aggregate Total Return Index Hedged NZD | Global bonds | |

Bloomberg Global Aggregate Total Return Index Hedged NZD | Global bonds |

Final note

Currency hedging is a useful strategy for mitigating the impact of currency fluctuations on global investments. The choice to hedge depends on an investor's objectives, risk tolerance, and market outlook. Smart offers both hedged and unhedged ETFs, providing investors with the flexibility to choose the option that best aligns with their investment strategy.

Footnotes:

Brookes, A et al. (2000, March) ( Can hedging insulate firms from exchange rate risk?; Reserve Bank of New Zealand Bulletin; Volume 63 No. 1, March 2000)

Correlation is a measure of how two markets or securities move in relation to each other. It is measured on a range from +1.0, which means they are perfectly correlated and move in lockstep, to -1.0, which indicates they move in opposite directions. A correlation of 0 means the two markets are not correlated. Figures here are based on Smart calculations.

This information is issued by Smartshares Limited (Smart), a wholly owned subsidiary of NZX Limited. Smart is the issuer and manager of the Smart Exchange Traded Funds. The product disclosure statements are available at smartinvest.co.nz. Past performance is not a reliable guide to future performance. The calculations and returns used in this article are illustrative and intended as a guide only, and are not an indicator of future returns.

The value of investments can go down as well as up and investors may not get back the full amount invested nor any particular rate of return referred to in this article. Returns are not guaranteed.

This information is intended to provide a general guide and is based upon, and derived from sources Smart considers reliable. Neither Smart nor NZX Limited, or their respective directors and employees accept any liability for any errors, omissions, negligent misstatements, or for the results of any actions taken, or not taken in reliance on this information. This information is not a substitute for professional advice.

In preparing this information Smart did not take into account the investment objectives, financial situation or particular needs of any particular person. Accordingly, before making any investment decision, Smart recommends seeking professional assistance from a licensed Financial Advice Provider.

More from Smart: